Increased Demand for Efficiency

The Construction Punch List Software Market is experiencing a notable surge in demand for efficiency in project management. As construction projects become increasingly complex, stakeholders are seeking solutions that streamline workflows and enhance productivity. This software enables real-time tracking of tasks, which can lead to a reduction in project delays. According to recent data, the construction sector has seen a 15% increase in the adoption of digital tools aimed at improving operational efficiency. This trend suggests that companies are prioritizing software that can facilitate better communication and task management, ultimately driving growth in the Construction Punch List Software Market.

Growing Focus on Project Transparency

Transparency in project management is increasingly becoming a priority within the Construction Punch List Software Market. Stakeholders are demanding greater visibility into project progress, which can be achieved through effective punch list management. Software solutions that offer real-time updates and detailed reporting capabilities are gaining traction as they foster trust among clients and contractors. Recent surveys reveal that 80% of clients prefer working with firms that utilize transparent project management practices. This growing emphasis on transparency is likely to propel the adoption of construction punch list software, as it aligns with the industry's shift towards accountability and open communication.

Rise of Remote Work and Digital Solutions

The rise of remote work has significantly influenced the Construction Punch List Software Market. As teams become more dispersed, the need for digital solutions that facilitate collaboration and communication has intensified. Construction punch list software provides a centralized platform for project stakeholders to access and update information from anywhere, thus enhancing coordination among teams. Data suggests that 60% of construction firms have adopted remote collaboration tools, indicating a shift towards more flexible work environments. This transition not only improves efficiency but also drives the demand for innovative software solutions that cater to the evolving needs of the construction industry.

Technological Advancements and Innovation

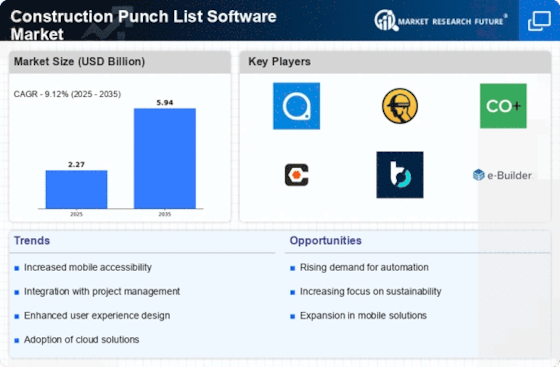

Technological advancements are a driving force in the Construction Punch List Software Market. The integration of artificial intelligence, machine learning, and data analytics into construction software is revolutionizing how projects are managed. These technologies enable predictive analytics, which can identify potential issues before they escalate, thereby enhancing project outcomes. Current trends indicate that the market for construction software is expected to grow by 25% over the next five years, largely due to innovations that improve efficiency and decision-making. This suggests that companies investing in advanced punch list software are likely to gain a competitive edge in the evolving construction landscape.

Regulatory Compliance and Quality Assurance

Regulatory compliance is a critical driver in the Construction Punch List Software Market. As construction regulations become more stringent, companies are compelled to adopt software solutions that ensure adherence to safety and quality standards. The software aids in documenting compliance processes, which is essential for avoiding legal repercussions and maintaining project integrity. Recent statistics indicate that 70% of construction firms report increased scrutiny from regulatory bodies, necessitating robust compliance mechanisms. This trend underscores the importance of construction punch list software in helping firms navigate complex regulatory landscapes while ensuring quality assurance throughout the project lifecycle.